Index

Overview

If you are using the Fully Uplifted tier of Uplifter, you can take advantage of the Uplifter Ledger Account features. All the information you may want to transfer to another accounting program can be found in the invoices that you process in Uplifter. To simplify this process, whenever an action is completed on an invoice, the details of that transaction can record to Uplifter's ledger report. You can setup Ledger Account codes in Uplifter to match the ledger accounts you have setup in your according accounting system to simplify your process. This will allow you to export a chronological report of all transactions that occurred during a specific time period and enter these same transactions (either individually or on aggregate) into your Accounting system.

Before you use this feature, PLEASE BE SURE YOU READ THIS ARTICLE CAREFULLY so you are aware of how Uplifter will record transactions to your ledger report. Each Ledger Account code type has differing rules on how tags and ledger account assignment will take place. Once a line has been recorded to your ledger, it cannot be edited. This type of immutable record keeping will provide bookkeepers, treasurers and accountants the clarity of any transactions that occur within Uplifter that maybe required to audit transactions that occur in Uplifter.

Webinar

Background

Recorded Account Types

- Assets - This is any invoice payment that you receive and mark as Paid

- Receivables – This is a type of asset, but an asset that you are planning on receiving at a later date – so any invoice payments that are marked as “Pending” or “Undeposited”

- Revenues – These are the amounts on your invoices describing what you have sold, or “Invoice Items” (basically anything ABOVE your subtotal line)

- Liabilities – This is any amount that Uplifter generates that you owe to another party. Currently the only two types of liabilities recorded are taxes and gift certificates

The Uplifter ledger report does not report balances on ledger accounts as these balances may change for other reasons outside of your Uplifter transactions (ie, you may have withdrawn money from the bank account you deposited your cheques and cash into or made a tax remittance to a governing body).

Accounting Crash Course

As per general accounting principles, all financial transactions are typically recorded as debits (the “left”) or credits (the “right”). Based on general accounting, any financial transaction should result in all amounts on the left equaling all amounts on the right.

- Asset and Receivable amounts are increased by recording an amount in the debit column. If you are decreasing one of these accounts, a positive value is recorded in the credit column.

- Revenue and Liability amounts are increased by recording an amount in the credit column. If you are decreasing one of these accounts, a positive value is recorded in the debit column.

Uplifter's Ledger Report will allow you to see updates to any of your asset, receivable, revenue and liability accounts based on a series of debits and according credits.

How Debits and Credits Are Recorded

Uplifter will record to your ledger whenever an update that relates to the financial details on a completed invoice are performed or when gift certificates are generated. So, in the case where someone completes a registration on your Uplifter site, Uplifter will record the following transactions:

- A credit to any according Revenue accounts based on what you have sold in the form of program registrations, programs or subscriptions

- A debit to any according Revenue accounts based on any discounts that may have been applied to your invoice items

- A credit to any according Liability accounts attached to any taxes you may collect against your invoice

- A debit to any Asset accounts where the according payments against the items you have collected revenue for above are marked as paid

- A debit to any Receivable accounts where the according payments against the items you have collected revenue for above are marked as pending (to be paid at a later date)

- A debit to any Liability accounts attached to any gift certificates that may have been used on the invoice

When installment payments are processed and changed from pending to paid, Uplifter records the following transaction:

- A credit to any according Receivable accounts to reduce the amount that was owed to you

- A debit to the Asset account that the payment was made against

Uplifter's Ledger Account features provides a club with as much control as is preferred to record to the according accounts. If you are an organization that would like to record to a single Asset, Receivable, Revenue and Liability account, you can certainly keep elements simply. As soon as you've added these accounts to your Ledger Accounts page and you activate your Ledger, all transactions will immediately begin recording to these according accounts and begin back-populating your ledger to the best of Uplifter's ability at the time of activation.

Before You Begin

Before you enable the Ledger Accounts feature within Uplifter, you'll want to review with your accountant, bookkeeper or treasurer how you would like Uplifter to populate your ledger account.

Learn More

This will require them to look at your according accounting system and find all the codes where they expect transactions to populate. Each organization will have completely different requirements and needs, so plan carefully based on your own needs. You may want to record cheque payments separate from your credit card payments. You may want to record revenues based on generic program registrations, products and subscriptions, or you may want to specify accounts at a category, category level or even specific program or product level. You may also want to record discounts or adjustments to separate revenue accounts for greater visibility in your accounting system.

You can update your Ledger Accounts at any time. Doing so will affect any future transactions after you've updated your accounts, but will not affect ledger lines retroactively.

Uplifter will not allow you to begin populating your ledger lines until you specify at least one default account that can be used for each of your:

- Asset Accounts

- Receivable Accounts

- Revenue Accounts

- Liability Accounts

This will ensure that any transactions that occur on your Uplifter site will balance with the according debits and credits.

Take the time to setup your accounts and review them carefully. You do not need to activate your ledger until you are sure that the accounts have been saved in the way you expect.

Ledger Accounts Setup

To begin, you will want to create default, "catch-all" accounts for each variation. Next, start with general accounts that will capture most of your processes. Finally, create your specific accounts to capture your one-offs and edge cases.

Remember: Specific trumps General. If you have a general account with the tag "Default For Programs" and a specific account with the tag "Kids Program Mondays @ 5" every program will fall into the general except the noted Monday program.

Create Your Default Accounts

- Click Add Account

- Enter your account code and name

- Ensure the Default radio button is marked

Learn More

Why Make Default Accounts? Default accounts are designed to catch the items you may have missed/forgotten about. Think of them like safety nets. Note that any account can be your default by using the Default Account radio button, but having a specified default account makes things much cleaner for your reports.

Create Your General Accounts

- Click Add Account

- Enter your account code and name

- Tag your general element(s)

- Ensure the Default radio button is not marked

Learn More

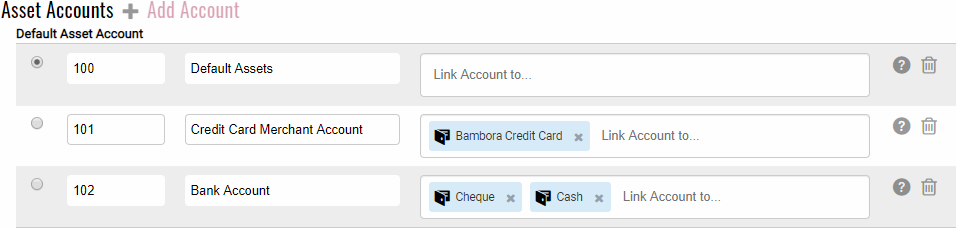

Example General Asset Tags: [Bambora Credit Card], [Cheque], [Cash], [Interac Online]

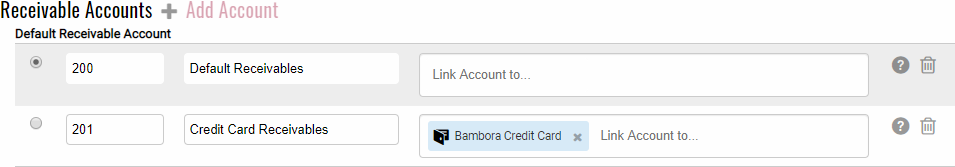

Example General Receivable Tags: [Bambora Credit Card], [Cheque], [Cash], [Interac Online]

Example General Revenue Tags: [Default for Programs], [Default for Negative Custom Line], [<club-specific category>]

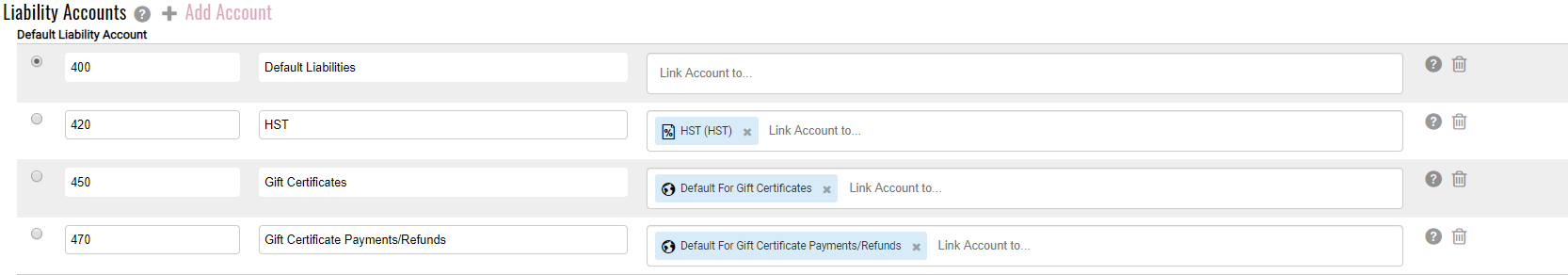

Example General Liability Tags: [Default for Gift Certificates], [Default for Taxes]

Create Your Specific Accounts

- Click Add Account

- Enter your account code and name

- Tag your specific element(s)

- Ensure the Default radio button is not marked

Learn More

You'll want to use specific accounts as sparingly as possible, as they often mean you will have to return to the ledger accounts time and time again to keep them up to date as new items are released.

Example Specific Asset Tags: N/A

Example Specific Receivable Tags: N/A

Example Specific Revenue Tags: [<club-specific category level>], [<club-specific program>], [<club-specific product>]

Example Specific Liability Tags: N/A

Notes On Account Types

Notes On Default Accounts

- Default accounts are designed to catch any items you may have missed

- Default accounts have no tags

- Default accounts have the Default Account radio button selected

- You should only have a single default account per account type

Notes On Asset Accounts

- Asset accounts record payments you have received and marked as Paid

- Asset accounts can use the Default or General account setups

- Some clubs may only use a Default account setup for their Assets

- General Asset accounts use payment methods as their tags. Ex. Cash, Cheque, Credit Card, etc.

Notes On Receivable Accounts

- Receivable accounts record payments you have not yet received. Any payment marked as Pending or Undeposited

- When a receivable is updated from their current status to Paid the according Receivables account will be credited and the according Asset account will be debited.

- Receivable accounts can use the Default or General account practices

- Some clubs may only use a Default account setup for their Receivables

- General Receivable accounts use payment methods as their tags. Ex. Cash, Cheque, Credit Card, etc.

Notes On Revenue Accounts

- Revenue accounts record the values of items you have sold, regardless of their associated payment status

- Receivable accounts can use the Default, General, or Specific account setups

- General Receivable accounts use categories, category levels, and "Default" tags.

- Default for Programs

- Default for Subscriptions

- Default for Products

- Default for Positive Custom Lines

- Default for Negative Custom Lines

- Default for Invoice Line Adjustment Charges

- Default for Invoice Line Adjustment Discounts

- Specific Receivable accounts use category levels, programs, products/tickets/subscription, and discount tags.

- Remember: Specific trumps General. You can have as many General and Specific accounts as you would like and Uplifter will find the most applicable account first, based on how specifically tagged that account is.

- Specific Trumps General (Products/Programs): Product/Program > Block Groups > Category Level > Category > General Revenue Account > Default Revenue Account

- Specific Trumps General (Adjustments): Discount > General Revenue Account > Default Revenue Account

Notes On Liability Accounts

- Liability accounts record the values your club owes other parties. Presently this is in the form of taxes and gift certificates

- Clubs that have multiple taxes should tag each individually in their own Liability accounts

- The two "Default for Gift Certificate... " tags (noted below) should be tracked individually in their own Liability accounts

- Liability accounts can use the Default, General, or specific account setups

- General Liability accounts use tax and "Default" tags.

- Default for Taxes

- Default for Gift Certificates (gift certificates created via Accounting > Gift Certificates)

- Default for Gift Certificate Payments/Refunds (gift certificates created by/used on invoices)

- Specific Liability accounts use taxes tags.

Special Notes On Gift Certificates

- Gift certificates created manually from the Gift Certificates page do not have a debit line to balance against within Uplifter. As such, your debits and credits will balance, less your Default For Gift Certificates account.

- Gift certificates created manually from the Gift Certificates page will show as a credit in your Default For Gift Certificates account. Once used they will appear as debits in your Default For Gift Certificate Payments/Refunds account.

- Gift certificates created via refunds will show a credits in your Default For Gift Certificate Payments/Refunds account.

Activate Your Ledger

- Check Activate Ledger

- Click Save

Learn More

Once you've added all of your ledger accounts you can activate your ledger. Before doing so, ensure you have reviewed all of your ledger accounts and how they've been defined. If you are unsure based on the documentation above, please feel free to contact us to ask us questions about how ledger lines maybe populated based on your created ledger accounts.

As soon as you check "Activate Ledger" and click "Save", Uplifter will begin going through all of your organizations previously completed invoices and generate the ledger lines based on the state of the invoices at the time of activation. This process may take some time, but rest assured, it will slowly populate in the background as you continue to work with Uplifter. As soon as you have activated your ledger, any transactions occurring after the fact will also be immediately recorded to the ledger as well.

Note that the ledger will be back-populated with as many details as is currently available in Uplifter and be a reflection of Uplifter at the current time. Installments that are currently paid will only be recorded in the asset lines and not a reflection of the original receivable record in concert with the credit to your receivable and debit to your asset account to indicate the then future payment.

Before activating your report, you may want to coordinate with a member on your team that manages the transfer of data to your accounting software. They'll want to determine what amounts have already been recorded into your accounting software to know what new records from the ledger report can be used on a go-forward basis.

Balancing Debits & Credits

Ledger Report

- Navigate to Reports > Ledger Report

- Filter as desired

- Pull or preview the report

Learn More